The Philippines is largely an agricultural country but our farmers also are one of the poorest in the country. They had little to no access to affordable loans as most of the banks are far from their area and the only accessible loans to them are from loan sharks which put an incredibly high interest which will make them more poorer.

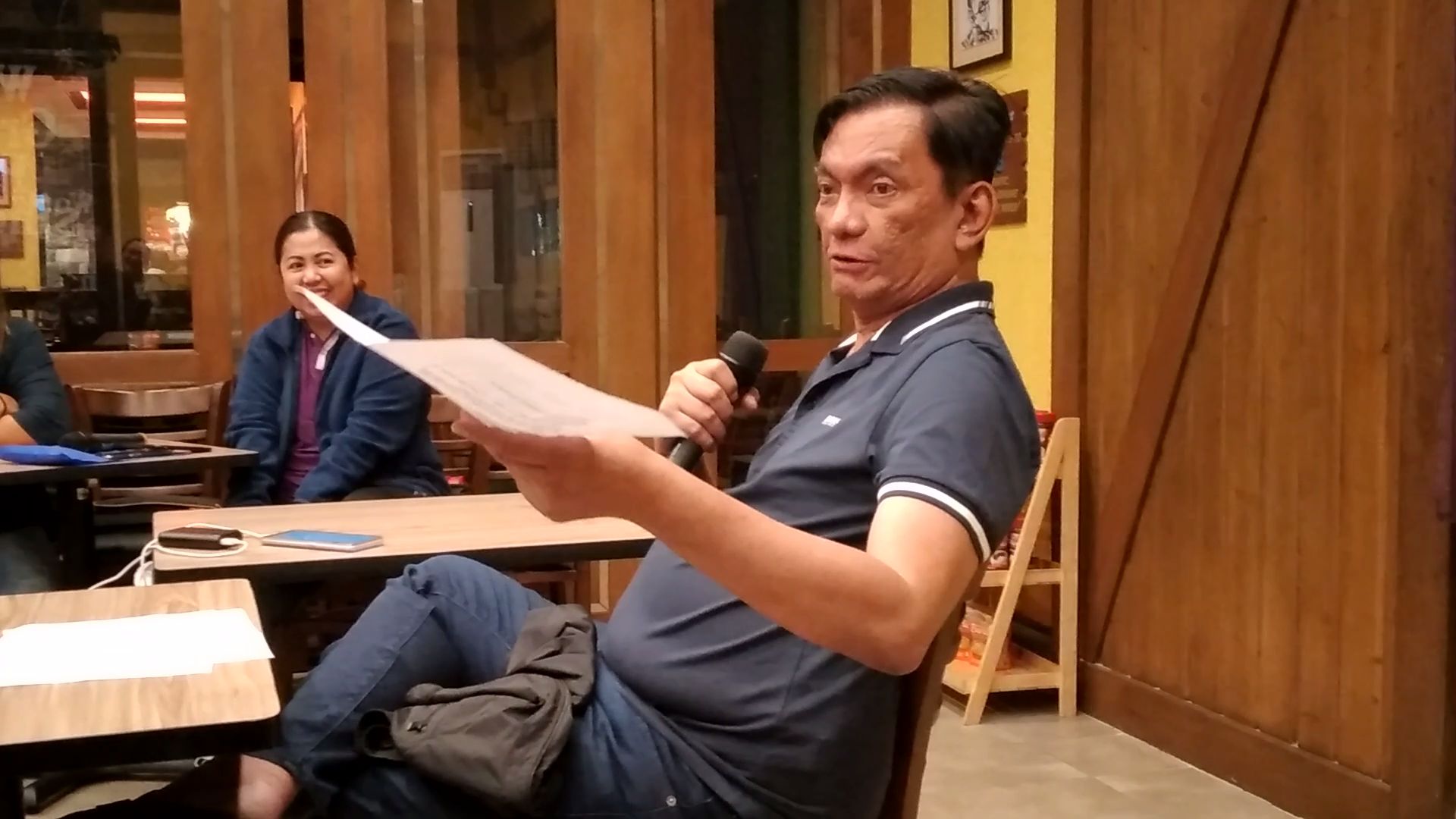

Albay 2nd District Rep. Joey Sarte Salceda has filed the “The Rural Agricultural and Fisheries Financing Enhancement System Act,” which will enhance the Agri-Agra Reform Act of 2009 and will ensure greater access to credit in rural communities. It is also a component of the banking reforms the Bangko Sentral ng Pilipinas (BSP) had requested to the Congress as part of its strategy to achieve the A-level credit rating the country is pursuing.

To ensure that banking services are actually accessible to farmers, however, Salceda has introduced enhancements to the proposal so that banks could also support missionary financial inclusion projects in rural communities.

Under the Salceda proposal, lending to programs or projects that seek to make financial services like virtual banking available at little or no cost to farmers can be considered in assessing a bank’s compliance with the Agri-Agra Reform Law.

“Agri-Agra requires banks to lend a certain portion of their portfolio to farmers and fisherfolk. Of course, it has not worked to the fullest because farmers aren’t banked in the first place. High-risk ang farmers for conventional banks. Bukod diyan, malayo ang bangko sa bukid. Marami pang requirements kaya magpapabalik-balik ka. Siyempre, ‘yung iba, sa malapit na five-six na lang hihiram.” Salceda said.

“Fortunately, we no longer have to do physical banking because of virtual applications that allow you to open a bank account in your cellphone and borrow from a BSP-registered bank. And because virtual banks operate at lower costs, mas mura ang loans na kayang ibigay. Virtual banking will grow even more accessible when my Virtual Banking Act is passed. Once that happens, my amendments to Agri-Agra will also help ensure that even farmers from remote communities can be included in the banking and lending system. Basta may signal – so let’s also pass the Public Service Act amendments.” Salceda added.

“The bills I have been filing are all interconnected. Social infrastructure, financial inclusion and protections, improvements in the business environment – all of them are part of a vision that foresees the country’s emergence as a predominantly middle-class society, yung pati farmer negosyante. These Agri-Agra amendments are crucial, especially the provision on financial inclusion for rural communities.” Salceda explained.

Salceda’s amendments to Agri-Agra respond to BSP Governor Benjamin Diokno’s request to Congress that key financial reform bills be passed so that the country could reach A-credit rating in 2 years.

The amendments also follow Salceda’s financial inclusion bills such as:

- A regulatory framework for virtual-only banking (HB 5913, or the Virtual Banking Act)

- Financial Consumer Protection Act (HB 5976), which will protect small-time investors from investment fraud