Taxation especially Income Taxation is a subject matter that is considered hard and tedious by most of us. It is something that most of us do want to avoid due to its complexity. We are having a hard time to understand it due to the terminologies that were used and also because the law concerning taxations were also hard to understand. The computations were also complex. Most of the books and learning materials that tackles income taxation were also too technical and cannot be easily understood by the students and common people.

Even though that income taxation is hard, we need to study and understand it especially that we are in a crisis. Knowing the right computation of the taxes that we need to pay can save us a lot of money especially when we know which incomes are exempted and which expenses can be declared as deductibles. Any error we make in filing or in computing the taxes might cost us more money and also trouble.

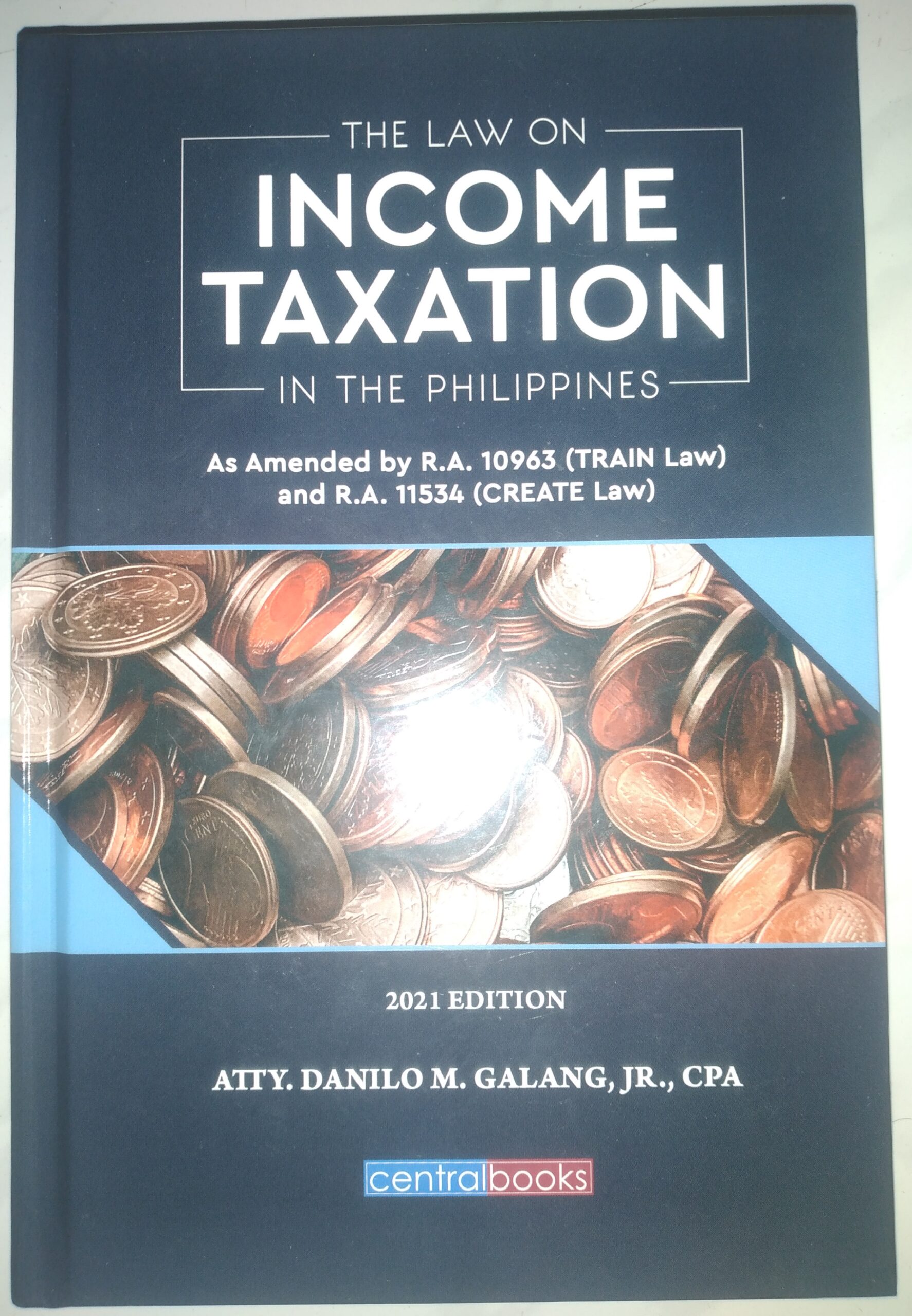

I have read a book titled “The Law on Income Taxation in the Philippines” which was written by Atty. Danilo M. Galang. This book tackles about income taxation especially personal and corporate income taxes based on R.A. 10963 (TRAIN Law) and R.A. 11534 (CREATE Law). This is great because the book is up-to-date as the CREATE Law was signed into law this March 26, 2021 and took effect last July 1, 2021. This book is unique as this is easy to understand and also very interesting to read. It has examples for us to easily understand the context of the law and also how the income tax computation works. You could learn a lot especially on knowing which incomes are tax exempt, what can be used as deductions and how to compute certain types of income.

A lot of people does not know that TRAIN Law has a lot of benefits especially the simpler tax rates. People who earn 250,000 pesos or less are exempted from income tax so this is a great news especially for new influencers and vloggers who just earn below the threshold as they do not need to worry about the income tax.

CREATE Law is a great news for business owners especially for the MSMEs. This law lowered the corporate income tax to 25% from the previous rate of 30%.

This book is great for everyone especially for law students, MSMEs, self-employed, and influencers. This is a must-have for business owners so that they can have a guide on how much income taxes they should pay and what are accepted as deductibles.